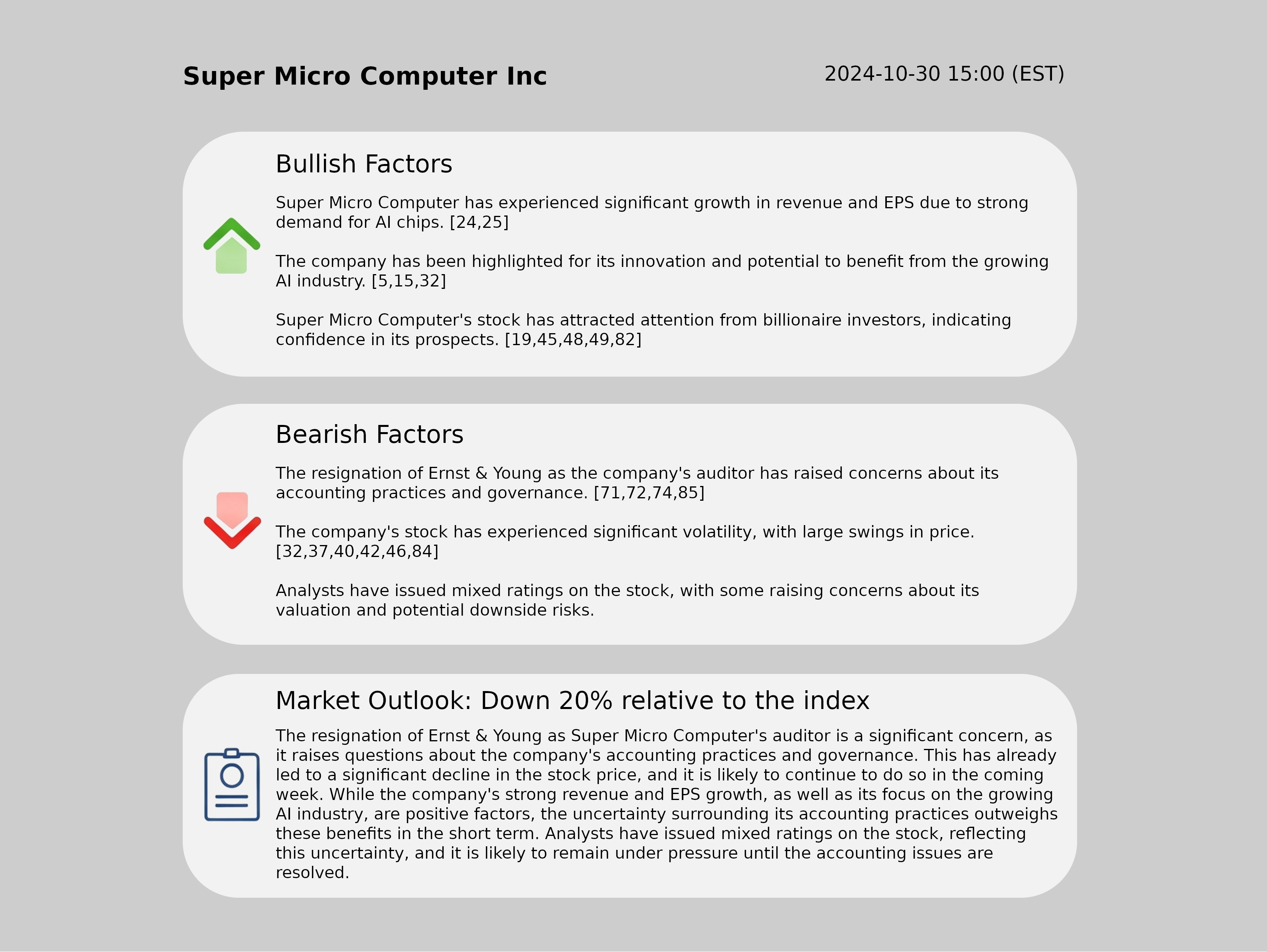

Analystant is an “Analyst Assistant” that streamlines information gathering and stock price forecasting for investors. When users specify a stock and date, the system retrieves a large amount of related news and data, automatically extracting the most important information. The extracted information is displayed, divided into factors contributing to stock price increases and decreases, and concludes with a forecast of the next week's stock price return. Since the basis for the forecast is clear, unlike traditional machine learning, users can choose to reference the forecast only when they are satisfied with the rationale.

It is suitable for a wide range of users, from professional fund managers and analysts to individual investors.

The use of generative AI, represented by ChatGPT, is becoming increasingly important in the asset management industry. However, implementing technologies such as RAG and fine-tuning in-house is no easy task. The generative AI implemented in Analystant has the following features, enabling investors to easily access generative AI tailored for investment that incorporates the latest technologies.

Based on large-scale language models such as ChatGPT, Gemini, and Llama, ensuring high accuracy in language processing

Uses only pre-selected, reliable stock price news and financial data for predictions

Enhances prediction accuracy by fine-tuning learning on the relationship between past stock prices and news/financial data to extract news with significant impact on stock prices

Continuous pre-training to learn writing styles and perspectives from existing analyst reports

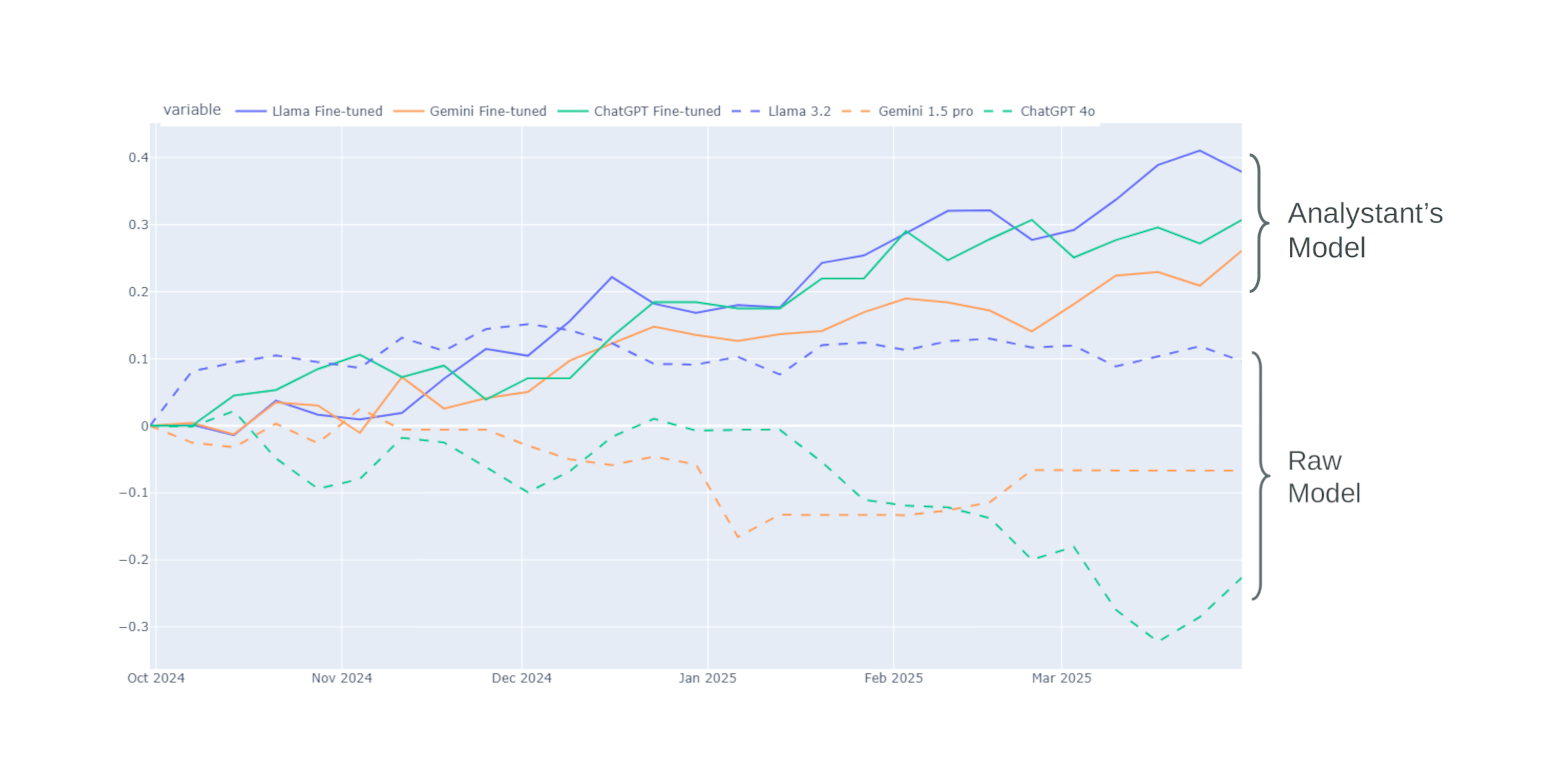

To verify the effectiveness of fine-tuning in identifying the relationship between stock prices and news data, we conducted a simple backtest targeting S&P 500 stocks. The model used the latest fine-tunable model available as of September 30, 2024, and was trained using data prior to that date. We predicted the stock price returns for the next week using data up to 8 AM EST on the second Monday of each week, and went long on stocks with returns exceeding 4% and short on those below -4%. The three fine-tuned models (Fine-tuned Model) all showed an increase, while the pre-fine-tuning model (Raw Model) remained flat or decreased.

This demonstrates the potential to enhance the accuracy of stock price analysis by training existing LLMs with additional data, and Analystant enables companies to easily incorporate such technology into their operations.

Users can also customize their own news sources and data, as well as their investment habits such as focusing on stock price overshoots or emphasizing ESG. Furthermore, with multi-agent functionality, multiple AI agents can discuss and reach conclusions allowing investors to build unique AI agents tailored to their preferences.